اكتشف وتداول عقود الفوركس

تداول أشهر أزواج العملات في العالم مع وسيط عالمي موثوق واستفد من انتشارات تنافسية وتنفيذ سريع وعمولات منخفضة

الرئيسية

الثانوية

الهامشية

العملات الشهيرة

EUR/USD

EURUSD

$

%

USD/JPY

USDJPY

$

%

GBP/USD

GBPUSD

$

%

USD/CHF

USDCHF

$

%

AUD/USD

AUDUSD

$

%

NZD/USD

NZDUSD

$

%

USD/CAD

USDCAD

$

%

EUR/JPY

EURJPY

$

%

EUR/GBP

EURGBP

$

%

EUR/CHF

EURCHF

$

%

EUR/USD

EURUSD

$

%

USD/JPY

USDJPY

$

%

GBP/USD

GBPUSD

$

%

#تداول_الفوركس

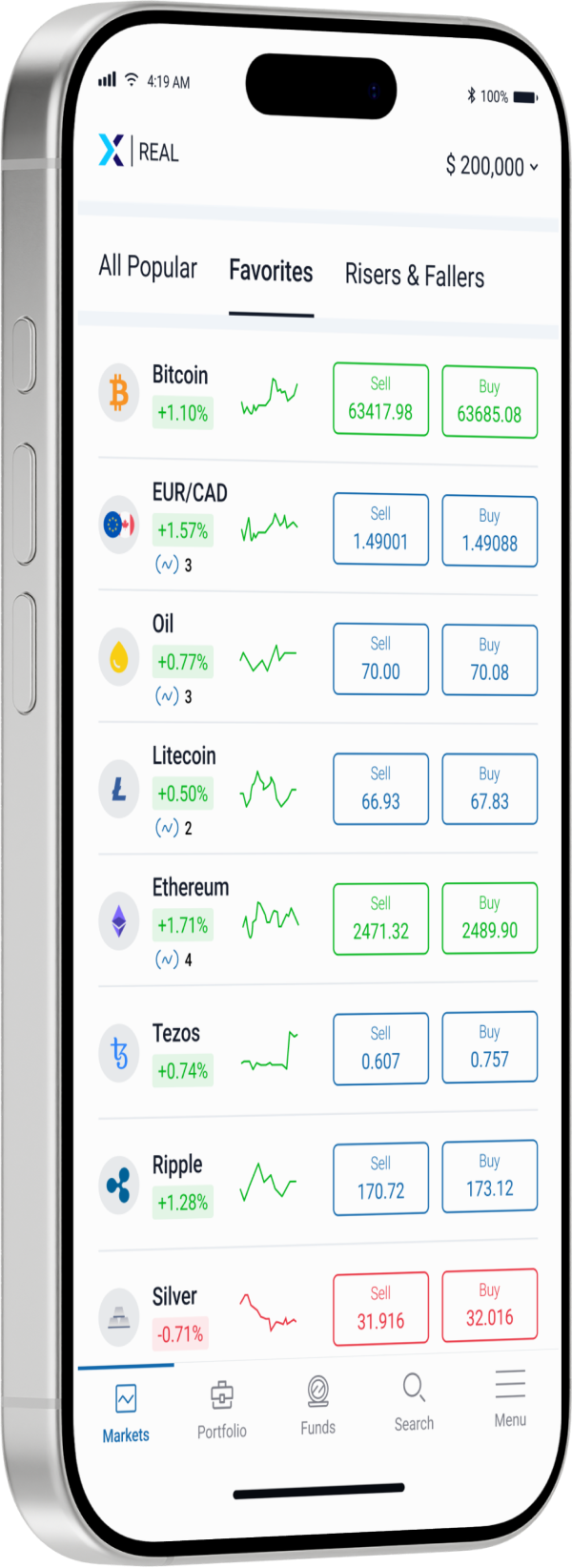

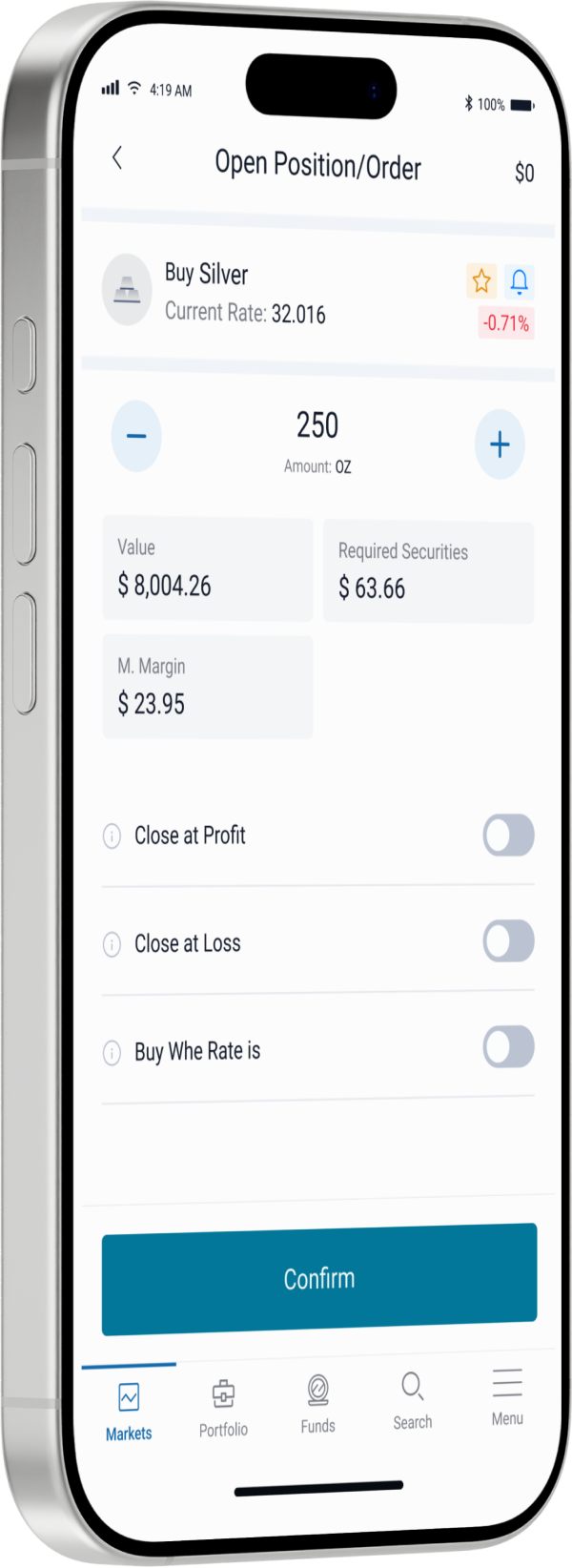

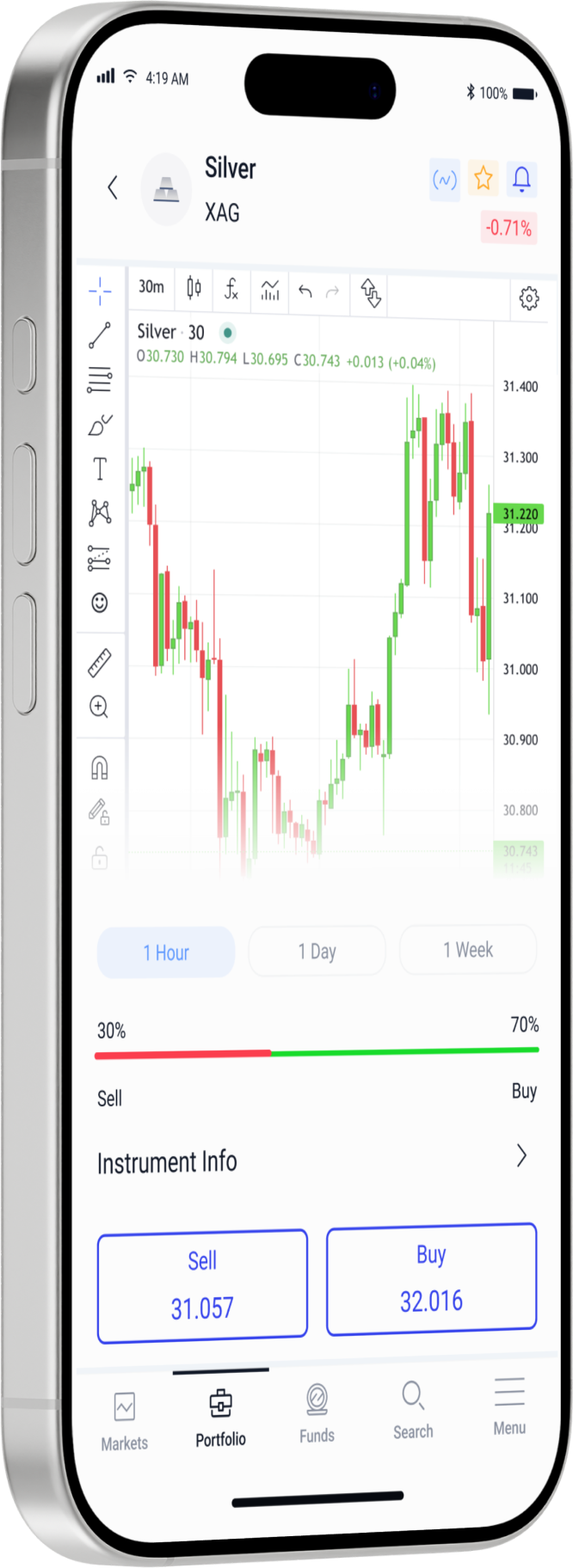

عن عقود الفوركس

سوق الصرف الأجنبي، المعروف أيضاً بسوق الفوركس، هو سوق مالي عبر الإنترنت يحمل لقب أكبر سوق متداول في العالم. XTrade تقدم للعملاء فرصة المشاركة في تداول الفوركس من خلال عقود الفروقات (CFDs). من خلال المشاركة في تداول الفوركس عبر CFDs، يمكنك استخدام أبحاثك وتحليلاتك للاستفادة من تقلبات أسعار الصرف، سواء كان ذلك بشراء أو بيع العملات استنادًا إلى توقعات الأسعار الخاصة بك.

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟