اكتشف وتداول عقود الفروقات للمؤشرات

تداول المؤشرات الشهيرة مع وسيط موثوق للحصول على فروقات تنافسية، وتنفيذ سريع، وعمولات منخفضة.

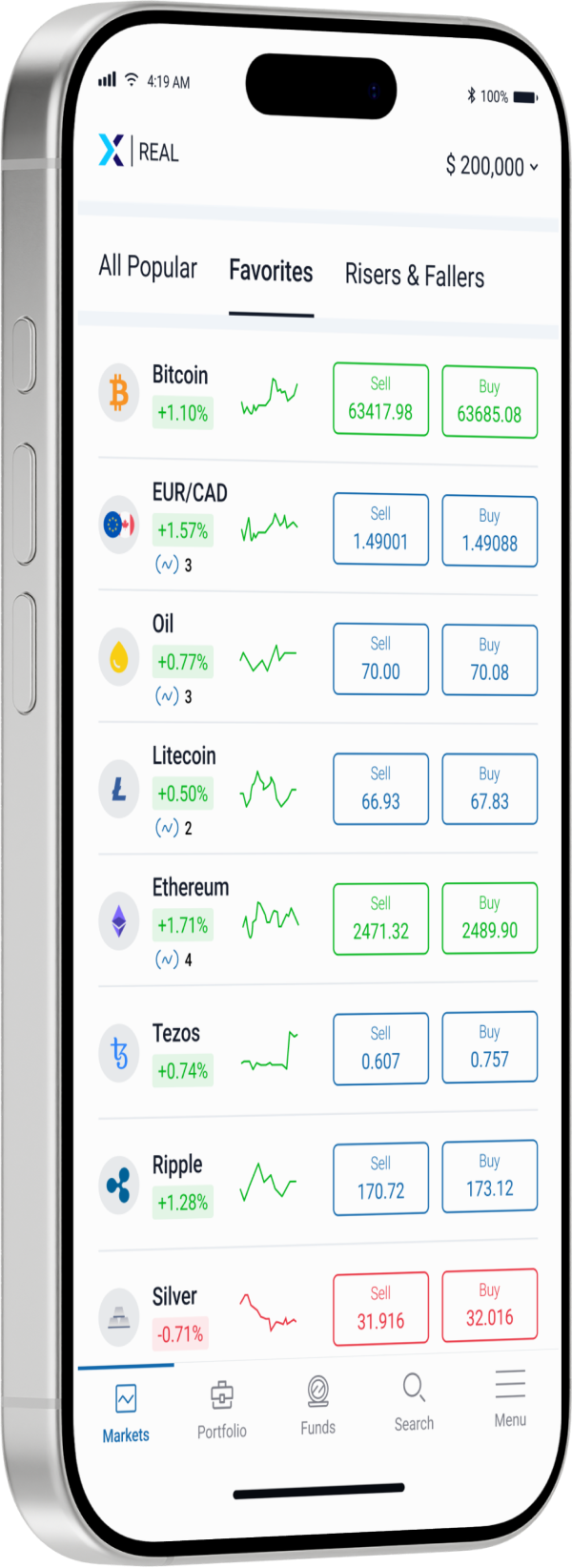

المؤشرات الشعبية

US-TECH 100

NDX

$

%

USA 30

YM

$

%

USA 500

ES

$

%

Russell 2000

RTY

$

%

US Dollar Index

DX

$

%

NASDAQ Composite

IXIC

$

%

US-TECH Cash

NASDAQ100

$

%

USA 30 Cash

US30

$

%

USA 500 Cash

SPX

$

%

AI Index

AI-Index

$

%

US-TECH 100

NDX

$

%

USA 30

YM

$

%

USA 500

ES

$

%

#تداول_المؤشرات

حول عقود الفروقات للمؤشرات

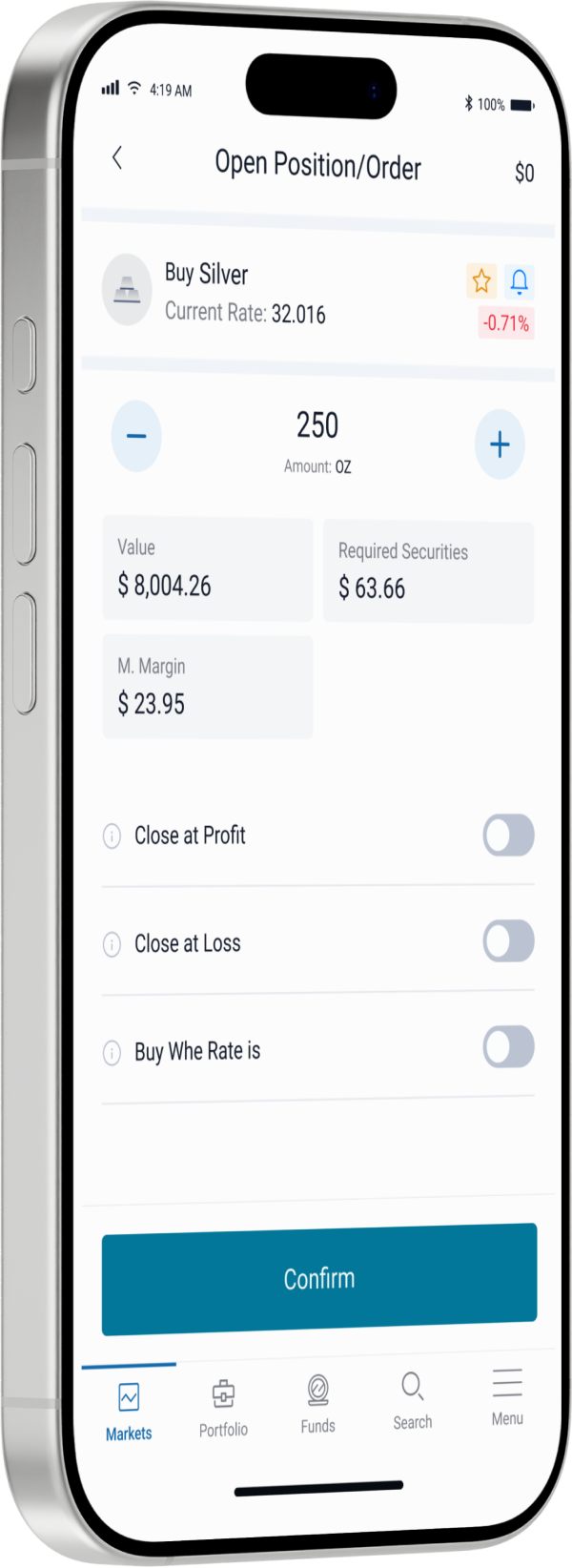

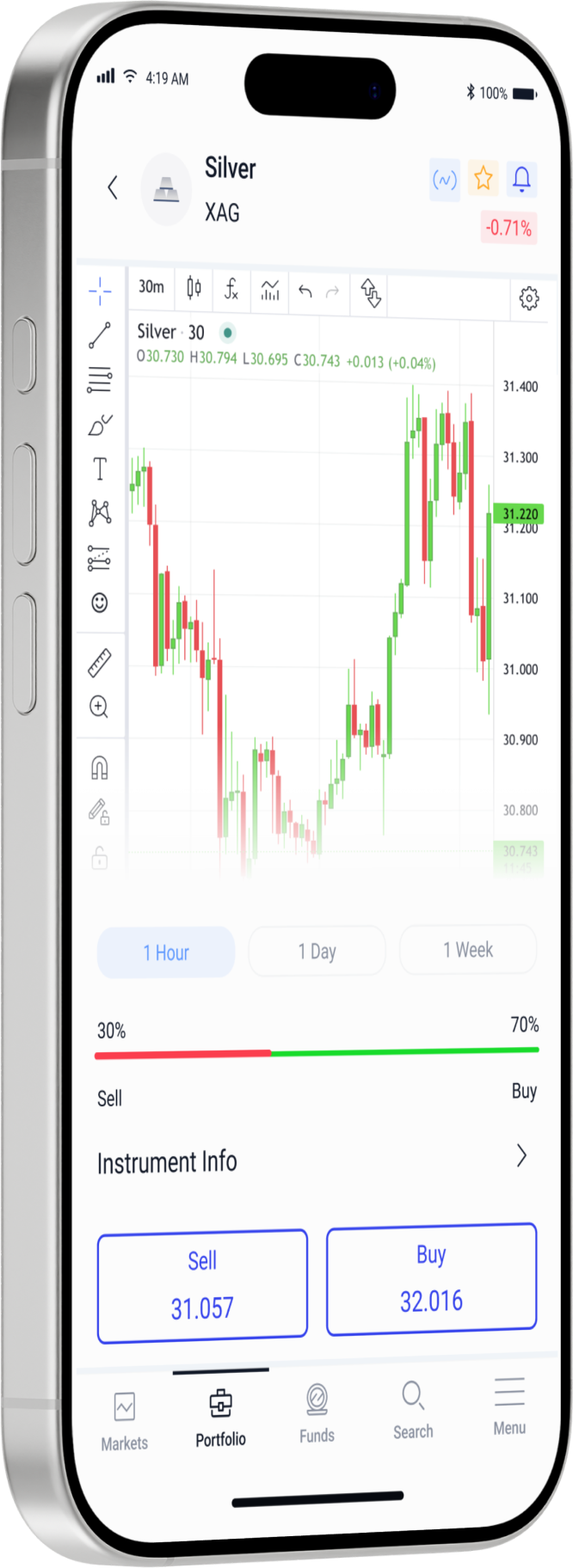

عقود الفروقات لمؤشرات الأسهم هي أدوات مالية تعكس قيمة مجموعات المؤشرات التي تتألف من شركات يتم تداول أسهمها بشكل عام، مثل S&P 500 وDow Jones Industrial Average وNASDAQ. يوفر تداول مؤشرات العقود مقابل الفروقات مجموعة متنوعة من الفرص الاستثمارية، مما يسمح لك بالتداول كل من الأسواق الصاعدة والهابطة.

مكتبة تعليم التداول

دليل شامل للتداول المحترف

قم بتعزيز مهارات التداول الخاصة بك مع مصادر تعليمية شاملة. قم بالوصول إلى دروس تعليمية وندوات ودورات تم تصميمها خصيصًا لأسلوب تعلمك. اتقن التحليل الفني والأساسي، وإدارة المخاطر، واستراتيجيات التداول الفعّالة. حقق أهداف التداول الخاصة بك بثقة.

#التفوقالتنافسي

لماذا نستثمر معنا؟